In day-to-day business transactions, the terms invoice and bill are often used interchangeably. While they may seem similar on the surface, they serve different purposes in accounting, taxation, and legal documentation. This confusion is common among small business owners, freelancers, startups, and even customers.

Understanding the difference between invoices and bills is crucial for accurate bookkeeping, GST compliance, timely payments, and avoiding legal complications. Using the wrong document or misinterpreting its purpose can lead to tax errors, delayed receivables, and compliance issues during audits.

What Is an Invoice?

Definition of an Invoice

An invoice is a formal commercial document issued by a seller to a buyer, requesting payment for goods sold or services rendered. It serves as an official record of a transaction and specifies the amount payable, along with payment terms.

In business and accounting, an invoice is used to:

- Record sales and revenue

- Track accounts receivable

- Support tax filings and audits

Who issues an invoice?

An invoice is issued by the seller or service provider.

To whom is it issued?

It is issued to the buyer or customer who has received the goods or services.

Purpose of issuing an invoice:

- To formally demand payment

- To provide transaction details

- To serve as proof of sale

- To comply with tax laws (such as GST)

In simple terms, an invoice is a payment request backed by legal and tax information.

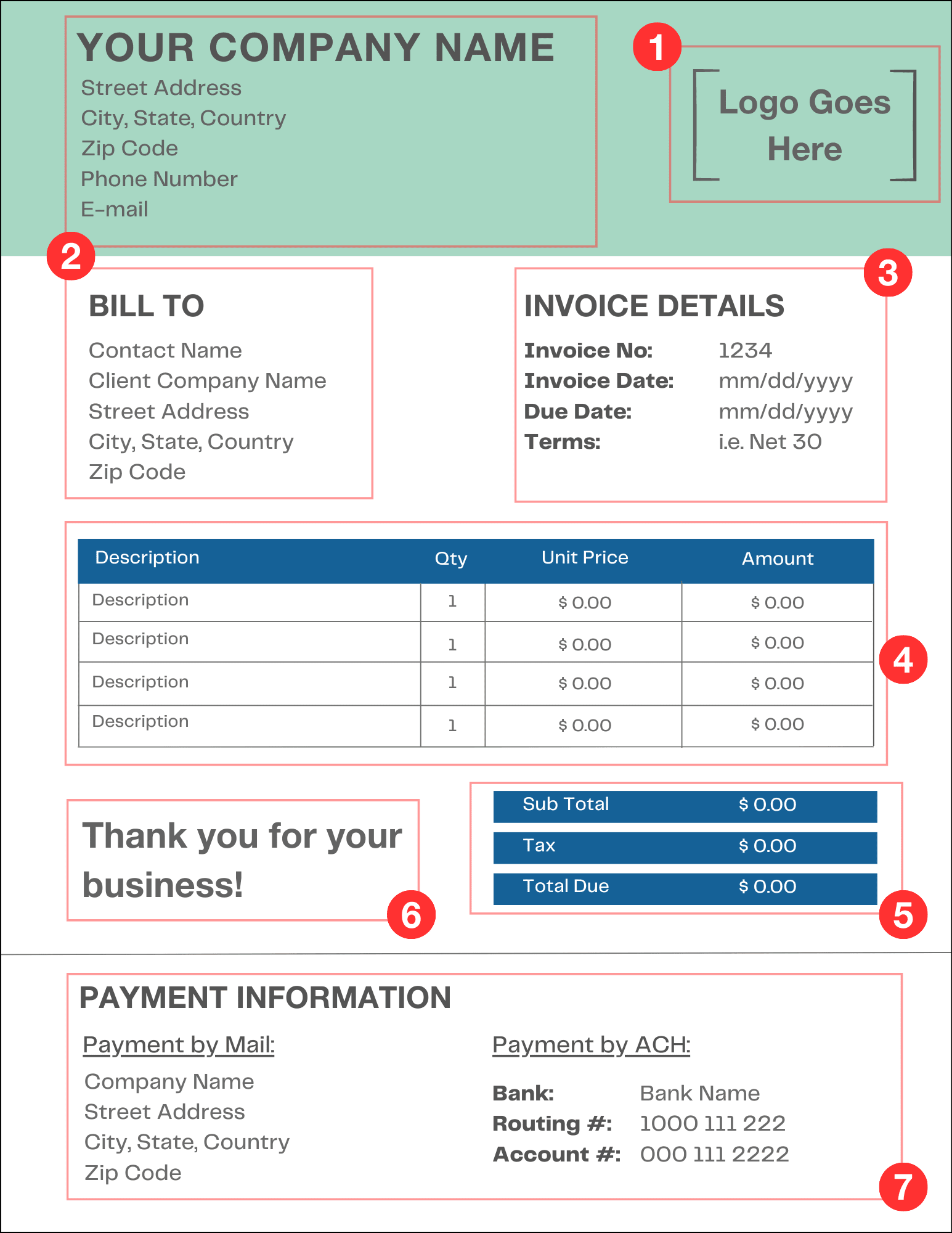

Key Elements of an Invoice

A valid invoice must contain certain essential details to be legally and commercially acceptable. These elements ensure transparency, accuracy, and compliance.

Key elements include:

- Invoice Number

A unique identification number that helps in tracking and record-keeping. - Date of Issue

The date on which the invoice is generated. - Seller and Buyer Details

Name, address, contact details, and GSTIN (if applicable) of both parties. - GST / Tax Details

Applicable tax rates, CGST, SGST, IGST, or other taxes clearly mentioned. - Description of Goods or Services

Clear explanation of what has been sold or provided. - Quantity, Rate, and Total Value

Unit price, quantity supplied, and the total amount before and after tax. - Payment Terms and Due Date

Credit period, payment mode, and last date for payment.

These components make an invoice a complete financial and legal document.

Types of Invoices Used in Business

Different business scenarios require different types of invoices. Some commonly used invoice types include:

- Tax Invoice

Issued under GST laws, showing tax details separately. Mandatory for registered businesses. - Proforma Invoice

A preliminary invoice sent before the actual sale, mainly for quotations or approvals. - Commercial Invoice

Used in domestic and international trade, especially for customs clearance. - Export Invoice

Issued for goods exported outside the country, often with additional export details. - Credit Invoice / Debit Invoice

Credit invoice reduces the invoice amount due to returns or discounts.

Debit invoice increases the payable amount due to additional charges.

Each type of invoice serves a specific accounting and regulatory purpose.

Legal Importance of an Invoice

An invoice is not just a payment document—it has strong legal and compliance significance.

Role of invoice in GST compliance:

- Mandatory for claiming Input Tax Credit (ITC)

- Required for GST returns (GSTR-1, GSTR-3B)

- Helps maintain accurate tax records

Invoice as a legal document:

- Acts as proof of sale or service

- Valid evidence in financial audits

- Used in case of disputes between buyer and seller

Use of invoice in audits and legal disputes:

- Supports revenue and expense claims

- Helps resolve payment disagreements

- Required by tax authorities during inspections

In essence, an invoice is a legally enforceable document that protects both businesses and customers.

What Is a Bill?

A bill is a simple financial document issued to request immediate payment for goods purchased or services availed. Unlike an invoice, which may allow a credit period, a bill is usually generated at the time of sale and is meant for instant settlement.

Bills are most commonly used in retail, hospitality, utilities, and day-to-day consumer transactions, where payments are made on the spot.

Definition of a Bill

A bill is a document that shows the amount payable for goods or services already received, typically requiring immediate payment.

Meaning of a bill in day-to-day and business usage:

In everyday transactions, a bill is commonly known as a receipt or payment slip provided after purchasing goods or services. In business usage, it acts as a transaction summary rather than a credit document.

Who issues a bill?

A bill is issued by the seller, retailer, service provider, or utility company.

When is a bill issued?

- At the point of sale

- After service completion

- When immediate payment is expected

Bills do not usually offer credit terms and are paid instantly via cash, card, or digital modes.

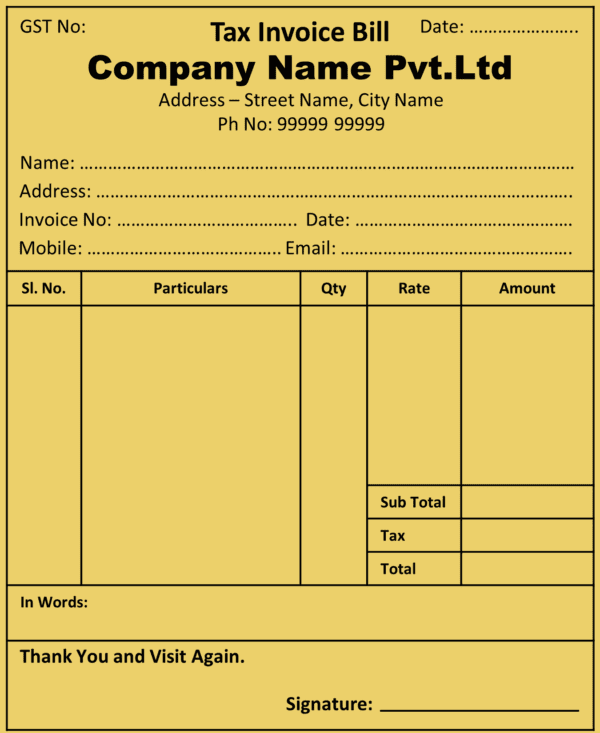

Key Components of a Bill

Bills are simpler than invoices and contain only essential transaction details.

Common components include:

- Bill Number (if applicable)

A reference number for internal tracking, mainly used by organized businesses. - Date

The date on which the purchase or service took place. - Seller Name

Name of the shop, outlet, restaurant, or service provider. - Items / Services Listed

Details of products purchased or services provided. - Total Amount Payable

Final amount to be paid, including applicable taxes or charges. - Payment Mode (Cash/Card/UPI)

Indicates how the payment was made or is to be made.

These components make a bill easy to understand and quick to process.

Common Types of Bills

Bills are widely used across various sectors for everyday transactions. Some common types include:

- Retail Bill

Issued by shops, supermarkets, and stores for consumer purchases. - Utility Bill

Generated by service providers for electricity, water, gas, internet, or phone services. - Restaurant Bill

Issued after dining, listing food items, taxes, and service charges. - Service Bill

Provided by professionals like salons, repair services, or local service providers.

These bills usually require instant payment and minimal documentation.

Legal Standing of a Bill

Is a bill a legal document?

Yes, a bill can be considered a legal document, but its legal strength is limited compared to an invoice.

Difference between tax bill and non-tax bill:

- Tax Bill: Includes GST or applicable tax details and can be used for tax records.

- Non-Tax Bill: Does not mention tax separately and is mainly for payment acknowledgment.

Use of bills as proof of payment:

- Acts as evidence of purchase

- Useful for warranties, returns, and reimbursements

- Accepted as basic financial proof, but not always valid for claiming input tax credit

Invoice vs Bill: Key Differences Explained

Although invoices and bills are often confused, they differ significantly in purpose, timing, legal standing, taxation, and accounting treatment. Understanding these differences helps businesses stay compliant and manage finances effectively.

Meaning and Purpose Comparison

An invoice is a formal request for payment issued by a seller after supplying goods or services, usually allowing a credit period. It acts as a commercial, accounting, and legal document.

A bill, on the other hand, is a simple payment document issued for immediate settlement. It mainly serves as a proof of purchase or payment, not a credit instrument.

In short:

- Invoice = Request for payment (often on credit)

- Bill = Demand for immediate payment

Timing of Issuance

Invoice:

- Issued after goods/services are supplied

- Can be generated before payment is received

- Often includes a due date (e.g., 15, 30, or 45 days)

Bill:

- Issued at the point of sale or service completion

- Payment is made immediately

- Common in retail, restaurants, and utilities

Timing is a key factor that separates invoices from bills.

Legal Validity

An invoice has strong legal validity and is recognized as an official business document. It can be used in:

- Tax filings

- Audits

- Legal disputes

- Credit recovery cases

A bill has limited legal standing. While it proves a transaction took place, it may not be sufficient in commercial or tax-related disputes, especially if it lacks tax details.

Tax and GST Applicability

Invoice under GST:

- Mandatory for GST-registered businesses

- Must include GSTIN, HSN/SAC codes, and tax breakup

- Required for claiming Input Tax Credit (ITC)

Bill under GST:

- May or may not include GST

- Non-tax bills cannot be used for ITC

- Often used by unregistered sellers or for small retail sales

GST laws clearly favor tax invoices over bills for compliance and reporting.

Payment Terms and Credit Period

Invoice:

- Allows credit periods

- Mentions payment terms and late fees

- Used in B2B transactions

Bill:

- No credit period

- Pay-and-go system

- Used mainly in B2C transactions

This difference directly impacts cash flow management.

Usage in Accounting and Bookkeeping

Invoice:

- Recorded as accounts receivable

- Used for revenue recognition

- Essential for audits and financial statements

Bill:

- Recorded as a completed sale

- Limited role in formal accounting

- Mainly used for expense tracking

Invoices play a much larger role in professional accounting systems.

Comparison Table: Invoice vs Bill

| Basis | Invoice | Bill |

|---|---|---|

| Meaning | Formal request for payment | Immediate payment document |

| Purpose | Credit-based transaction | Instant settlement |

| Issued By | Seller or service provider | Retailer or service provider |

| Timing | After supply, before payment | At point of sale |

| Credit Period | Yes | No |

| Legal Validity | High | Limited |

| GST Applicability | Mandatory for GST compliance | Optional |

| Input Tax Credit | Allowed (if GST invoice) | Not allowed |

| Accounting Use | Accounts receivable | Proof of payment |

| Common Usage | B2B, wholesale, exports | Retail, utilities, restaurants |

Invoice vs Bill in Indian Business & GST Context

India’s GST framework places greater importance on invoices than bills, especially for registered businesses.

Role of Invoices Under GST Law

Under the CGST Act, 2017, a tax invoice is mandatory for:

- Supply of taxable goods or services

- Claiming Input Tax Credit

- Filing GST returns

Invoices act as the primary document for GST compliance.

When GST Invoice Is Mandatory

A GST invoice must be issued when:

- The supplier is GST-registered

- The transaction involves taxable supply

- Goods or services are supplied to another registered person

Failure to issue a GST invoice can lead to penalties.

Can a Bill Be Used Instead of an Invoice?

- For GST-registered businesses: No

- For small, unregistered sellers: Yes

- For B2B transactions: Not acceptable

- For B2C retail sales: Acceptable (subject to value limits)

A bill cannot replace a GST invoice where tax compliance is required.

Penalties for Improper Invoicing

Improper invoicing under GST can result in:

- Monetary penalties

- Denial of Input Tax Credit

- Interest on unpaid taxes

- Legal notices and audits

Incorrect or missing invoices can seriously impact business credibility and compliance.

When to Use an Invoice?

An invoice should be used whenever a transaction involves credit, taxation, or formal business accounting. Below are common scenarios where issuing an invoice is essential.

B2B Transactions

In business-to-business dealings, invoices are mandatory. Companies rely on invoices to:

- Track payments

- Record expenses

- Claim Input Tax Credit (ITC)

Most B2B transactions operate on credit, making invoices indispensable.

Credit Sales

Whenever goods or services are sold with a deferred payment option, an invoice must be issued. It clearly mentions:

- Amount due

- Payment deadline

- Late payment terms

This protects both buyer and seller.

Export and Import Transactions

Invoices are crucial in international trade. Commercial and export invoices are required for:

- Customs clearance

- Foreign exchange compliance

- International tax documentation

Without invoices, shipments may face delays or rejection.

Service-Based Businesses

Professionals such as consultants, IT firms, logistics providers, and agencies use invoices to:

- Bill clients periodically

- Maintain revenue records

- Comply with GST regulations

Invoices help in transparent service billing.

Tax-Compliant Transactions

GST-registered businesses must issue tax invoices for taxable supplies. These invoices:

- Enable GST return filing

- Allow ITC claims

- Ensure compliance with Indian tax laws

Invoices are the backbone of tax-compliant business operations.

When to Use a Bill?

Bills are best suited for instant payment and everyday consumer transactions where formal credit documentation is not required.

Retail and B2C Sales

Retail shops, supermarkets, and malls issue bills for:

- Consumer purchases

- On-the-spot payments

- Low-risk transactions

These bills act as payment confirmation.

Immediate Cash or Digital Payments

When customers pay via:

- Cash

- Card

- UPI

- Wallets

A bill is generated instantly, completing the transaction.

Small-Value Transactions

For low-value sales where detailed tax documentation is unnecessary, bills provide:

- Quick checkout

- Simple records

- Customer convenience

Daily Consumer Purchases

Bills are commonly used for:

- Grocery shopping

- Fuel stations

- Restaurants

- Salons and local services

They suit high-volume, fast-moving transactions.

Invoice vs Bill: Examples for Better Understanding

Example of an Invoice Transaction

A manufacturing company supplies raw materials worth ?2,00,000 to a distributor on 30 days credit. The seller issues a GST tax invoice mentioning:

- GST details

- Due date

- Payment terms

The distributor pays after 30 days and claims ITC using the invoice.

Example of a Bill Transaction

A customer eats at a restaurant and receives a bill of ?850, pays via UPI, and leaves. The bill:

- Confirms payment

- Lists food items

- Includes GST (if applicable)

No credit or follow-up is required.

Simple Real-Life Business Scenarios

| Scenario | Document Used |

|---|---|

| Office purchases laptops on credit | Invoice |

| Grocery store purchase | Bill |

| Export shipment | Invoice |

| Salon service payment | Bill |

| Consulting service to a company | Invoice |

Common Misconceptions About Invoice and Bill

“Invoice and Bill Are the Same”

While similar in appearance, they differ in purpose, timing, and legal use. Treating them as the same can cause compliance issues.

“Bills Can Replace Invoices for GST”

This is incorrect. GST law requires tax invoices for registered businesses. Bills without GST details cannot be used for ITC claims.

“Invoices Are Only for Large Businesses”

Even small businesses, freelancers, and startups must issue invoices if:

- They sell on credit

- They are GST-registered

- They deal in B2B transactions

Invoices are not limited to large enterprises.

Importance of Correct Documentation in Business

Using the right document—invoice or bill—has a direct impact on business efficiency and compliance.

Impact on Accounting Accuracy

Proper documentation ensures:

- Accurate financial records

- Easy reconciliation

- Clear revenue tracking

Invoices especially help in structured bookkeeping.

Tax Compliance and Audits

Correct invoices help businesses:

- File GST returns smoothly

- Avoid penalties

- Pass audits without complications

Improper documentation increases audit risk.

Legal Protection and Dispute Resolution

Invoices act as legal proof in case of:

- Payment disputes

- Contractual disagreements

- Tax investigations

Bills offer limited legal protection.

Professional Image of the Business

Issuing proper invoices and bills:

- Builds trust with clients

- Enhances brand credibility

- Reflects professionalism and transparency

Correct documentation strengthens both business operations and reputation.